PROJECT OVERVIEW

Closet is a new type of app.

BUSINESS CHALLENGE

Closet is a business with a big ambition – to provide everyone a place to offload their inner conversations.

SOLUTION

A place to bring route to your dialogue

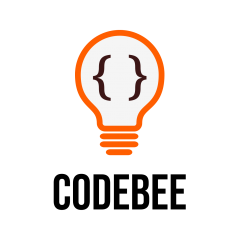

Taking on the loyalty penalty heads-on

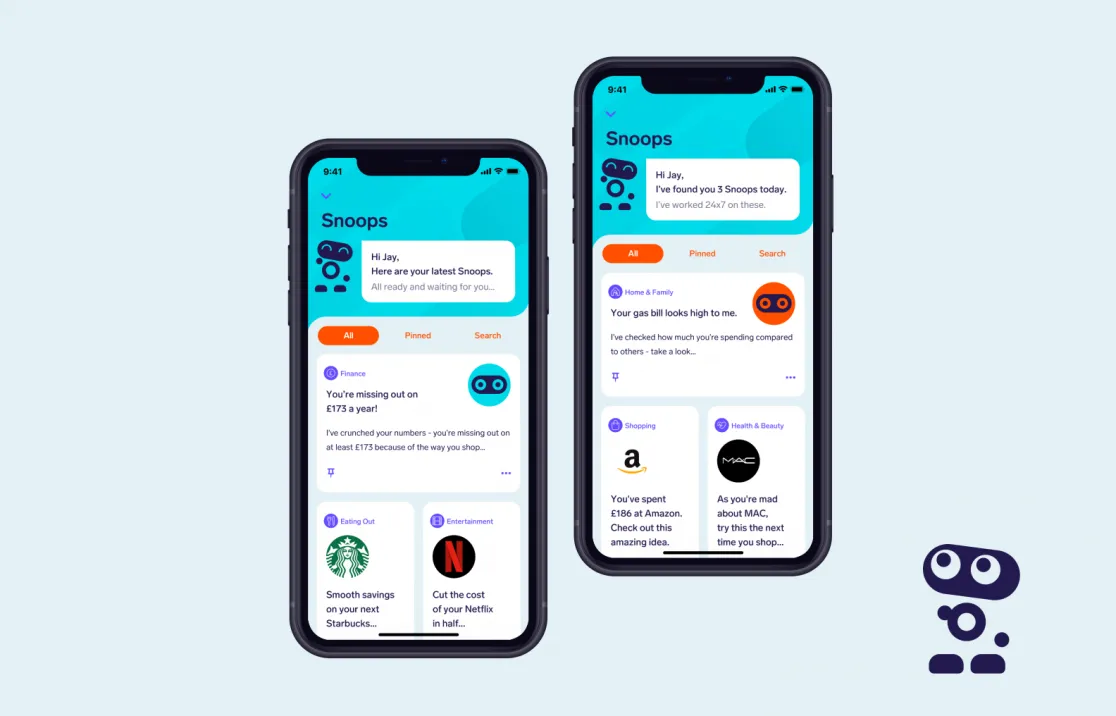

Additionally, the recently launched Payment Hub, is a central place where customers can keep on top of all their bills, regular payments and subscriptions.

Customers can see exactly how much they’re spending, how often, what’s gone up and down, next expected payments and more.

This feature directly tackles the ‘loyalty penalty’ faced by tens of millions of people across the UK.

Too many people are spending over the odds on utility bills, insurance and broadband without knowing. Snoop wants to change this and help put pounds and pence directly back in customers pockets.

Linking regular bills to a service (e.g. energy, mobile, mortgage), Snoop actively helps keep track and find a better deal when customers need one. It takes away the leg work and energy needed to avoid expensive auto-renewals and makes it easy to switch key services so customers aren’t on a bad deal for a second longer than they need to be.

By using Open Banking data to spot when customers need to be switching and to nudge them to do so through a highly engaging, frequent-usage app experience means Snoop helps people put money back in their own pocket, not boost the profits of big business.

Applying deep intelligence to financial data

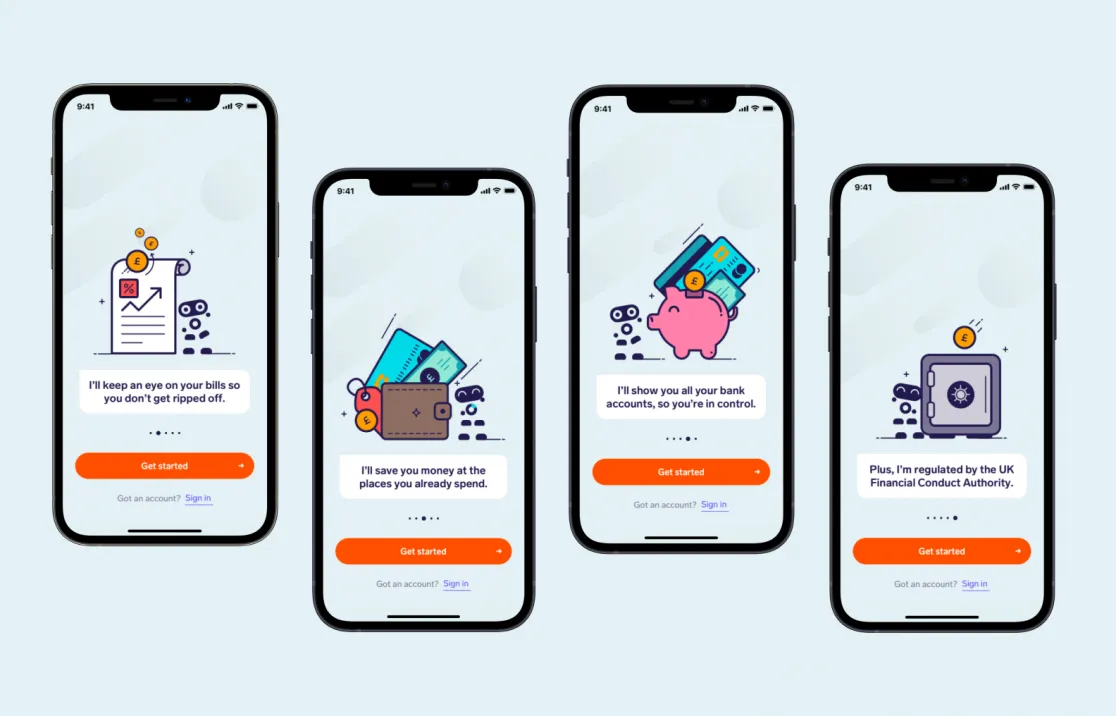

The robust technology upon which Snoop is built is key to creating customer value through personalisation, bill and spend forecasting, trends and actionable insight.

The app is underpinned by cutting-edge artificial intelligence and a custom machine learning model, which is applying intelligence to a dataset that’s never really had it before.

Snoop processes millions of transactions from users on a daily basis and the engine is able to analyse it in real-time. Applying rules-based and machine learning procedures, the platform matches money advice and appropriate actions to users based on their transactional information to create a hyper-personalised experience that gets increasingly more precise with time.

While banks and other startups have dipped their toes into beautifying data for spending categorisation and money management, Snoop’s AI is driving personalisation more akin to the dynamic and data-driven big media platforms such as Netflix and Instagram than a bank.

Ultimately, Snoop’s business model is a fair and transparent one and is based on a core belief that customers should be in control of their financial data. Snoop only makes money when the customer is switching to save themselves money. Snoop makes banking, money management, price comparison and switching services more intelligent and personalised – and ultimately more rewarding for customers.

Helping one community save £75,000

On average, Snoop customers save £1,500 per year, but in some instances, Snoop unearths an insight that has a considerable impact on the community.

An example to illustrate the power of the app: Snoop was able to pinpoint that some people in the Milton Keynes area might have been paying over the odds for their water bills. The app prompted users to check to see if they were paying for ‘surface water drainage’ – rainfall that falls on a property and drains away into public sewers. This charge is often added to bills even if the charge is not relevant, but it is up to the customer to find this out themselves and request a claim.

Based on this insight a customer successfully claimed £230 from Anglian Water. He shared the insight with his neighbours and soon realised the rest of his neighbours on his Housing Estate had been overcharged. After several more successful individual claims, Anglian Water initially agreed to look at a group claim for all 378 properties on the development.

The result: Snoop helped one community get a £75,000 rebate.

When you consider the niche nature of this money-saving insight, you can see the vast potential of the business across mainstream bills and spending.